NAPLES ISLAND, CA

- Loan amount $1,105,000

- 12 Mo Refi, possible 1yr ext

- 65% Loan to Value

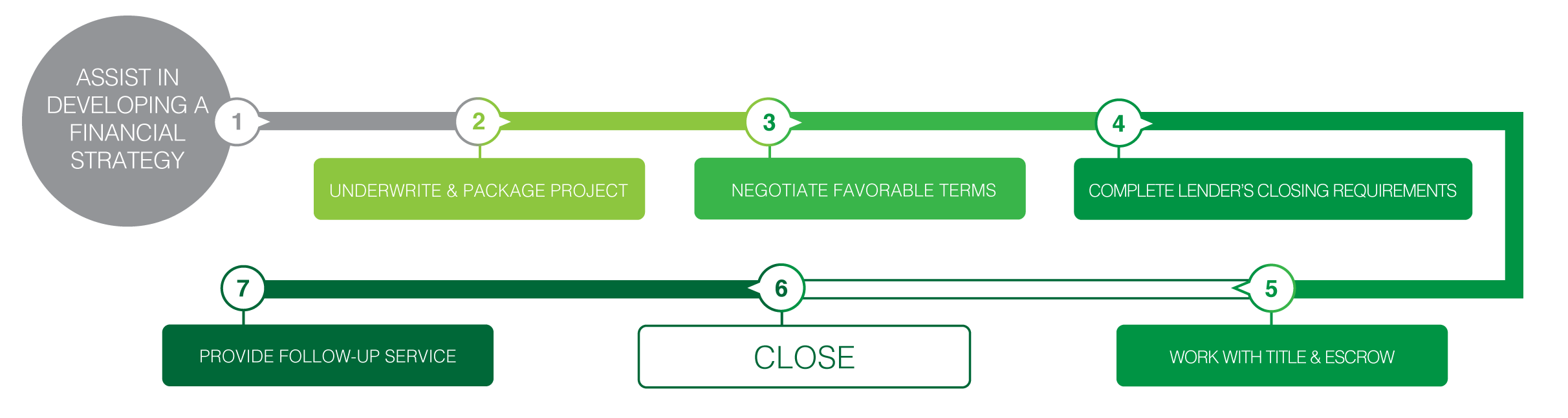

With Brentwood Finance Company, commercial real estate financing has never been easier to attain. As an industry-leading commercial group with deep roots in the San Francisco Bay Area, we offer creative, direct lending and brokerage services. We have experience financing all aspects of commercial and investment real estate, which means we can cater our lending programs to your individual needs. Partnering with our commercial loan advisors means access to a team that knows the industry and is committed to helping you achieve your financial goals.

As a direct and correspondent lender, we can offer competitive rates and creative lending options many traditional lenders do not offer.

We work closely with our borrowers to ensure they are partnered with the correct loan product for their project.

Brentwood offers both recourse and non-recourse loans.

Since we are a small, family office we are able to fund loans quickly.

We offer competitive terms and transaction fees.

Our team of highly effective, professionally trained industry professionals puts their experience to work to negotiate the most favorable terms on behalf of our clients.

Give us a call.

Want to find out more about our financing solutions?

Simply give us a call and our team of investment specialists will find a solution for you.